Summary (TL;DR):

Retailers are preparing for the 2024 holiday season, drawing insights from 2023, where total U.S. retail sales reached $964.4 billion, a 3.8% increase from 2022. Early shopping trends saw 25% of U.S. online adults begin holiday purchases in October or earlier, with 80% choosing online over in-store shopping during Thanksgiving weekend. Smartphones and social networks are key shopping tools, especially for younger consumers. Discounts, free shipping, and loyalty programs drive customer decisions. To stay competitive, businesses are investing in improved search, retail media, and seamless delivery. Data-driven strategies and extended shopping periods will define the 2024 holiday season.

Key Takeaways:

- 2023 holiday retail sales grew 3.8% to $964.4 billion, with 86% of U.S. online adults participating.

- 25% of shoppers began in October or earlier, and 63% purchased leading up to Thanksgiving.

- 75% of consumers made at least half their purchases online, with smartphones driving 63% of holiday shopping.

- Discounts (49%), free shipping (48%), and loyalty programs (64%) strongly influenced shopping behavior.

- Businesses are focusing on improved product search, retail media, and seamless delivery experiences to meet consumer expectations.

Retailers are likely to spend a hefty chunk of their annual marketing budget to drive all-important holiday sales. Saying it's crucial period for retailers is a major understatement. According to recent data, around 15.6% of total ecommerce revenue is generated in the fourth quarter (Q4) of the year, representing a significantly higher proportion compared to other quarters, according to U.S. Census Bureau.

Using and understanding data from 2023 can help companies better prepare for the 2024 holiday shopping season.

Total US retail sales during the November and December 2023 holiday season grew 3.8% over 2022 to $964.4 billion, according to the National Retail Foundation, based on US Census Bureau data. Forrester’s 2023 preholiday season forecast predicted that sales growth would be driven by continued consumer spending and low US national unemployment. Overall, 86% of US online adults shopped for the 2023 winter holiday season.

Consumers Start Early

- 75% of U.S. online consumers made at least half of their holiday purchases online in 2023, up from 71% in 2022 (Bizrate Insights).

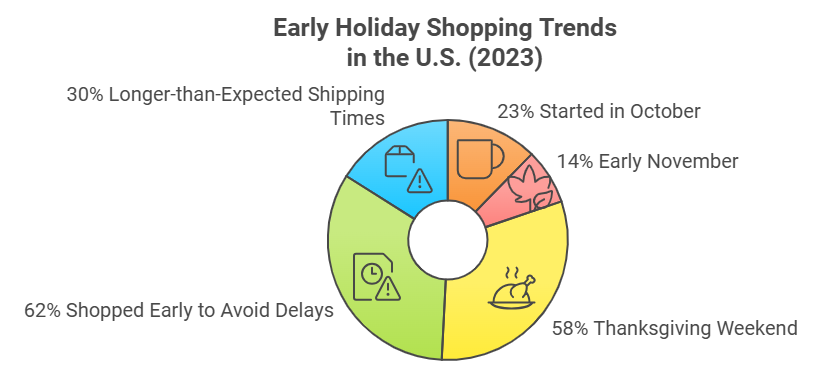

- There is a trend toward an extended shopping season. 25% of US online adults begin holiday shopping in October or earlier. (NRF, 2023)

- 23% of U.S. online adults started holiday shopping in October; 14% in early November. (Forrester, 2023)

- 58% of U.S. online adults saw Thanksgiving weekend as the biggest online shopping period. (Bizrate Insights, 2023)

- 80% shopped online rather than in stores over the Thanksgiving weekend. (Forrester, 2023)

- 63% made purchases in the days leading up to Thanksgiving. (Forrester, 2023)

- 75% of U.S. online consumers made at least half of their holiday purchases online in 2023, up from 71% in 2022. (Bizrate Insights, 2023)

- 62% of U.S. online adults shopped early in 2023 to avoid late deliveries; 30% reported longer-than-expected shipping times. (Forrester, 2023)

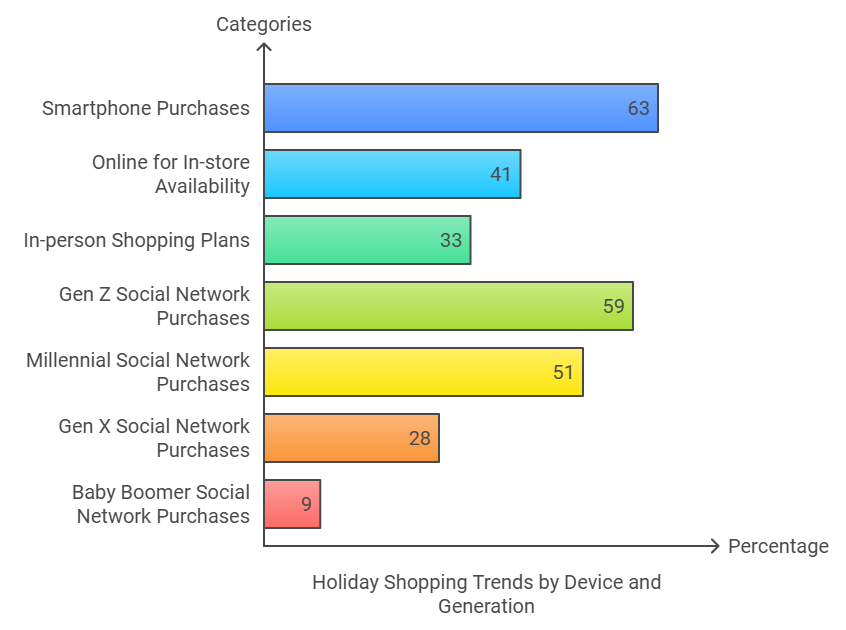

How Shoppers Find and Access Retailers

- Smartphones are the go-to holiday shopping device: 63% of smartphone users regularly use their devices to make purchases. (Forrester, 2023)

- 41% check online for in-store product availability, while 33% plan to do more in-person shopping. (Bizrate Insights, 2023)

- 59% of Gen Z and 51% of Millennials have purchased within a social network, compared to 28% of Gen X and 9% of Baby Boomers, (Forrester, 2024)

What Shoppers Want

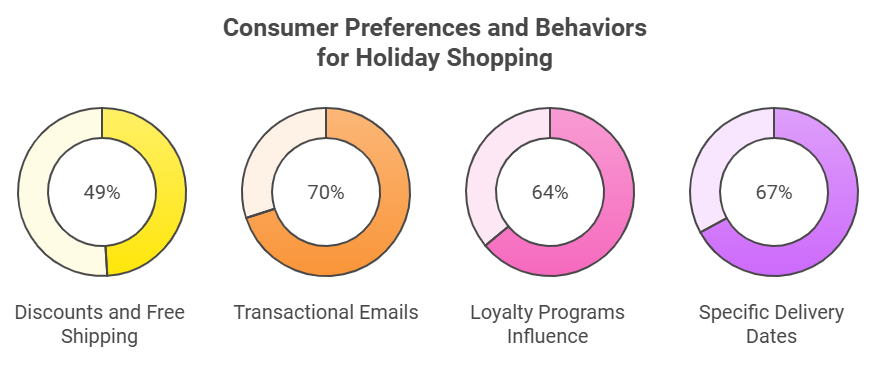

- 49% of consumers want discounts on total orders and free shipping (48%). (Bizrate Insights, 2023)

- U.S. online adults prefer transactional emails (70%) over promotional (45%) and personalized emails (33%). (Forrester, 2024)

- Loyalty programs influence shopping habits for 64% of consumers; 75% see them as money-savers and 64% say loyalty programs affect where they shop (Forrester, 2024)

- 45% of U.S. online adults pay attention to in-store ads, while 41% avoid online video ads. (Forrester, 2024)

- 67% want specific delivery dates shown in their shopping cart; 73% value order status updates (Forrester, 2024).

Investments by Businesses

- 93% of digital business leaders are investing in improved search and product discovery. (Forrester, 2024)

- 52% of U.S. online adults rely on a brand’s website search function to find products. (Forrester, 2024)

- 63% of B2C marketing decision-makers plan to increase retail media investments in 2024. (Forrester, 2024)